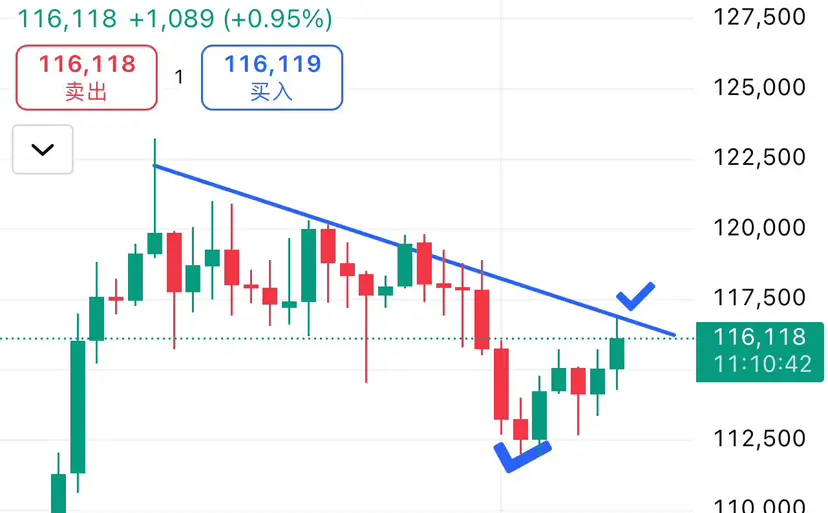

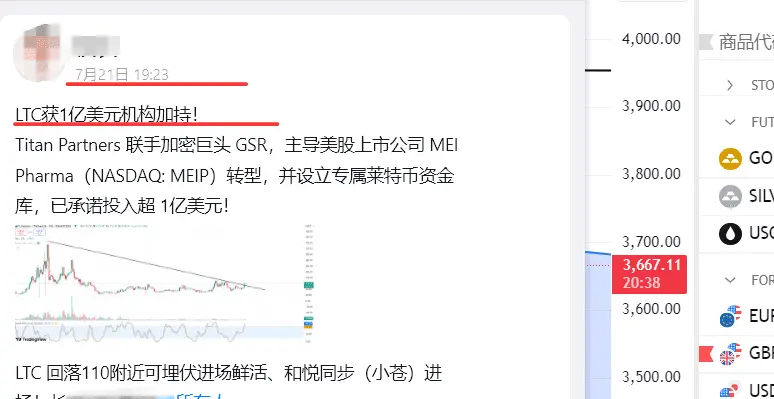

As the market cycle progresses, the altcoin sector is about to enter a new active period. For investors with certain financial strength, closely monitoring on-chain data will be a wise move. The current hotspots may mainly focus on tokens issued recently, with an expectation of 1-3 potential projects emerging on the three major public chains. The initial fully diluted valuation of these projects (FDV) typically does not exceed 100 million USD, and if they can successfully launch on large exchanges, they are expected to aim for a valuation target of 1 billion USD.

However, investors do not need

View OriginalHowever, investors do not need