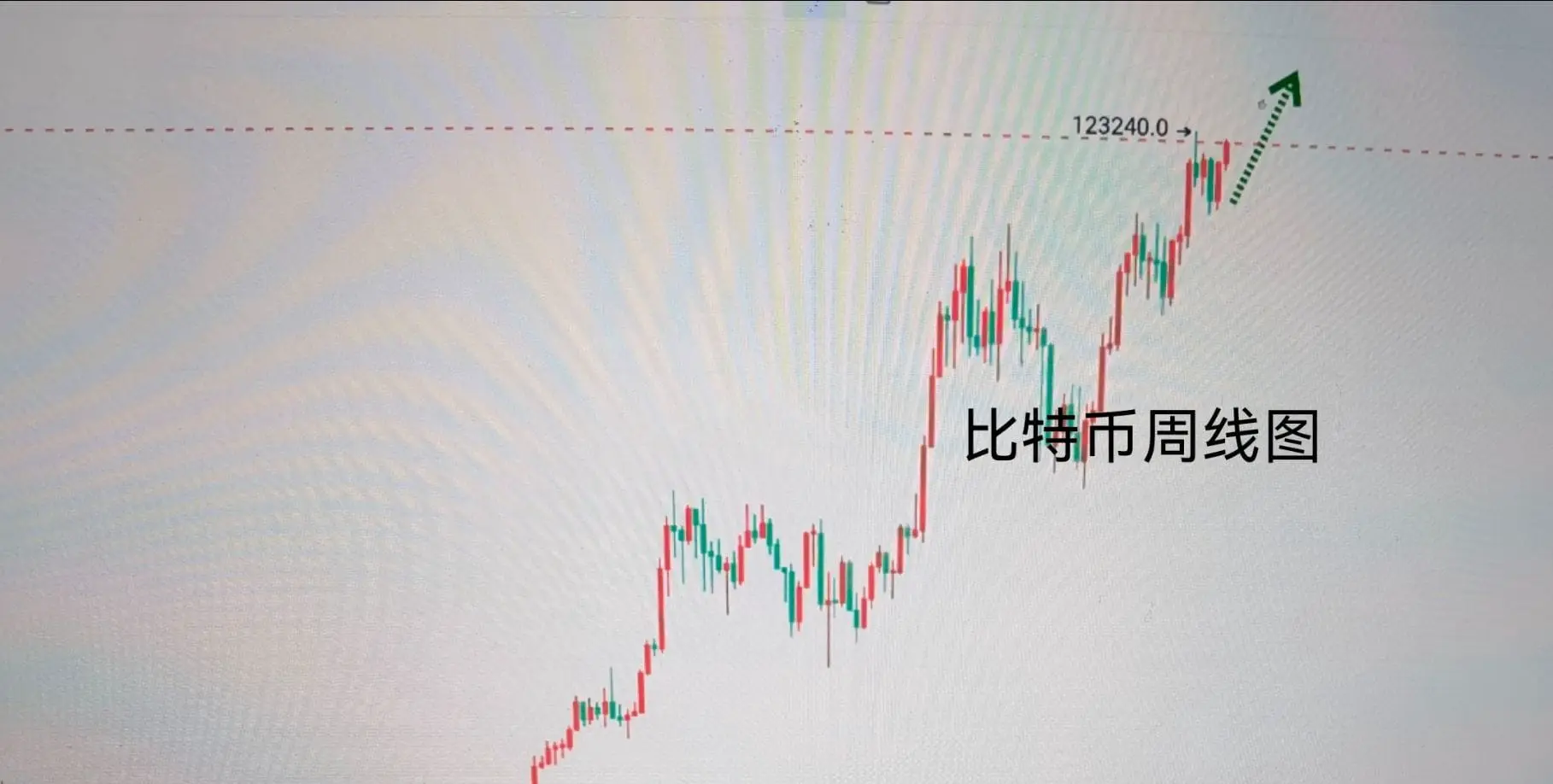

Recently, the Crypto Assets market has shown a complex trend. Bitcoin displays characteristics of range-bound fluctuations on the 4-hour chart, with the clarity of the trend diminishing. Technical Analysis indicates that the market is in a phase of intense competition between long and short positions. After experiencing a rise in five waves, Bitcoin seems to be entering a downtrend in the three waves, with short positions currently holding a slight advantage.

The market is about to face a key resistance level at $120,800. If this level cannot be broken, the upside potential will be limited, an

View OriginalThe market is about to face a key resistance level at $120,800. If this level cannot be broken, the upside potential will be limited, an